America’s Shifting Trade Deficit: What 2023 Reveals About U.S. Economic Trends

Breaking Down the Numbers: What the 2023 Trade Deficit Trends Signal for U.S. Policy

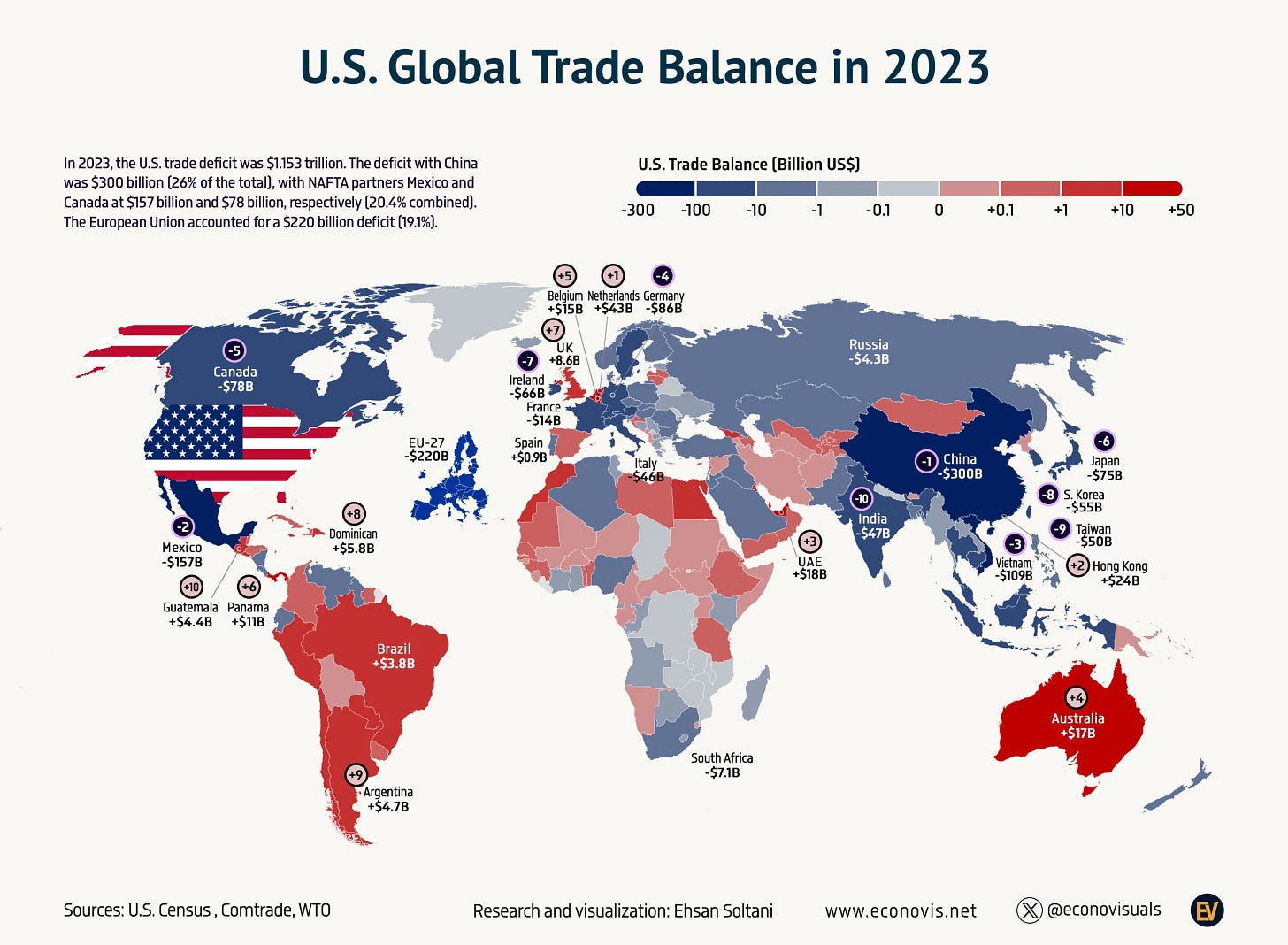

The U.S. trade deficit, long a flashpoint in economic policy debates, experienced significant shifts in 2023, particularly in its relationships with China, Mexico, and Canada. While the gap with China narrowed dramatically, trade imbalances with North American partners continued to widen. These patterns not only highlight evolving global supply chain dynamics but also raise questions about the long-term effectiveness of current trade agreements.

The China Deficit Shrinks, But the Relationship Remains Complex

The U.S. trade deficit with China fell to $279.4 billion in 2023, a sharp $102.9 billion decrease from the previous year. This shift was largely driven by a significant drop in imports, which fell by $109.1 billion. U.S. exports to China also dipped slightly, declining by $6.2 billion to $147.8 billion.

Several forces appear to be at play here. Ongoing tariffs imposed during the U.S.-China trade war have reshaped import patterns, while geopolitical tensions and China's own economic slowdown have tempered bilateral trade. Additionally, many U.S. companies have begun diversifying their supply chains, reducing reliance on Chinese manufacturing—though not eliminating it entirely.

While the narrowed deficit might seem like a policy success, it masks a deeper reality: China remains America’s largest source of imported goods, underscoring the continued economic interdependence between the two powers.

Mexico: A Rising Trade Gap Reflecting New Supply Chains

By contrast, the U.S. trade deficit with Mexico surged to $152.4 billion in 2023, an increase of $21.9 billion from the previous year. This rise was fueled by a jump in imports, which climbed by $20.8 billion to $475.6 billion, while exports to Mexico edged downward by $1.1 billion.

Mexico’s expanding role as a U.S. trade partner reflects shifting global supply chains. As companies move production closer to home—partly in response to pandemic-era disruptions—Mexico has emerged as a major manufacturing hub, particularly in industries like automobiles, electronics, and machinery.

However, this trend also raises questions about the effectiveness of the U.S.-Mexico-Canada Agreement (USMCA). Enacted in 2020 as a modernization of NAFTA, the deal aimed to reduce trade imbalances through stricter labor standards and rules of origin requirements. Yet, since its implementation, the U.S. trade deficit with Mexico has steadily grown, suggesting structural factors may be outweighing policy adjustments.

Canada: A Declining Deficit, But Persistent Imbalance

The U.S. trade deficit with Canada, while smaller, remains substantial at $67.9 billion. It did shrink by $12.2 billion compared to 2022, driven by a $15.5 billion drop in imports. Exports to Canada also declined, though more modestly, by $3.2 billion.

The energy sector remains central to this relationship, with oil and natural gas dominating U.S. imports from Canada. The dip in both imports and exports may reflect broader economic cooling and shifts in global energy markets rather than direct policy impacts.

What Drives These Deficits?

Trade deficits often spark debate about their implications, but they arise from a complex web of factors rather than a single cause. Among the primary drivers:

Consumer Demand: The U.S. remains one of the world’s largest consumer markets, leading to high import volumes, especially for manufactured goods.

Currency Exchange Rates: A strong U.S. dollar makes imports cheaper but reduces the competitiveness of American goods abroad.

Supply Chain Adjustments: Geopolitical tensions and pandemic disruptions have shifted global manufacturing hubs, benefiting Mexico while reducing Chinese imports.

These structural forces highlight why trade deficits persist despite policy interventions.

Are Trade Policies Working?

The USMCA, designed to rebalance trade with Mexico and Canada, has yet to deliver on its full promise. While it introduced more rigorous labor protections and domestic content rules, the persistent rise in deficits suggests those adjustments haven't meaningfully shifted overall trade flows.

Similarly, the tariffs imposed on Chinese goods during the Trump administration—largely maintained under President Biden—may have contributed to lower Chinese imports but have not significantly boosted U.S. exports or reshored manufacturing. Instead, some supply chains have simply shifted to other regions, with Mexico as a primary beneficiary.

Trade Deficits: Red Flag or Economic Reality?

The persistence of trade deficits often fuels political debates, but the economic reality is more nuanced. A trade deficit—importing more than a country exports—doesn’t inherently signal economic weakness. It often reflects strong consumer demand and globalized supply chains rather than declining industrial capacity.

However, long-term deficits can pose challenges. They may signal vulnerabilities in domestic manufacturing or overreliance on foreign supply chains, particularly in critical industries like technology and pharmaceuticals.

Looking Ahead: What Policymakers Should Watch

As the U.S. navigates an evolving global economy, the 2023 trade figures underscore the need for a broader reassessment of trade strategies. Key considerations include:

Can USMCA Be Strengthened? The persistent deficits with Mexico and Canada suggest the agreement may need further adjustments, particularly in enforcement mechanisms.

How Sustainable Is the Shift from China? While imports from China have dropped, the global market remains interconnected. A complete decoupling seems unlikely.

Is Manufacturing Competitiveness a Bigger Issue? Beyond trade agreements, investment in domestic manufacturing capacity may be crucial to addressing imbalances.

Ultimately, the 2023 data reflects a shifting but still imbalanced landscape. While the reduction in the China deficit offers a sign of diversification, rising gaps with North American partners reveal the limits of trade agreements alone. As global supply chains continue to evolve, both policymakers and businesses will need to adapt—or risk falling behind in an increasingly competitive economic environment.