Q2 GDP Estimate Rises, but the Story Beneath the Surface Still Matters

Growth Accelerates, Confidence Stabilizes, and Tariff Policy Takes Center Stage

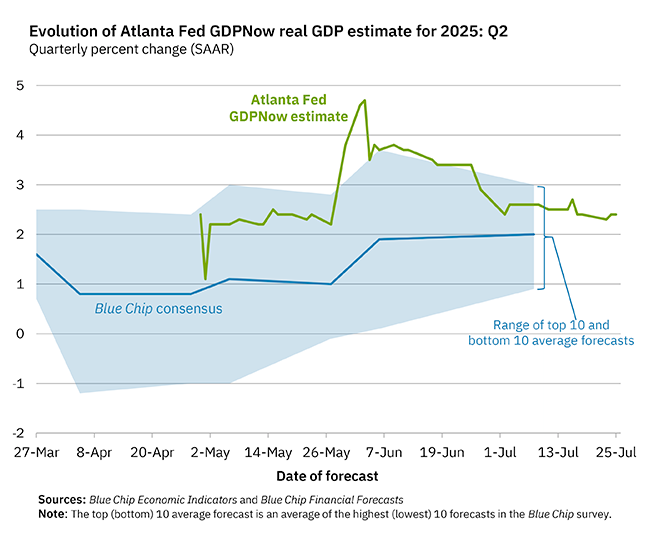

By all accounts, the American economy appears to have shaken off its winter malaise. The Atlanta Federal Reserve’s GDPNow model, a real-time estimator that aggregates government-reported data, has lifted its projection for Q2 2025 real GDP growth to 2.9%, up sharply from 2.4% just four days prior. If this holds, it would mark a stark reversal from Q1’s -0.3% contraction, signaling that the economy may have found its footing again.

But before the champagne is uncorked in Washington or on Wall Street, it’s worth asking: What is actually driving this rebound? And how durable is it?

The GDPNow revision owes much of its strength to a surprising improvement in the U.S. goods trade deficit. Specifically, the net exports contribution to GDP jumped from 3.31% to 4.04%, a bump that accounts for nearly all of the model’s upward revision. That shift, in turn, stems from a decline in imports, a development some analysts attribute to the front-loading of purchases earlier this year in anticipation of President Trump’s renewed tariff regime. In short, a slowdown in inbound cargo could be inflating the nation's growth numbers.

Simultaneously, the real gross private domestic investment component—a vital barometer of business confidence—deteriorated further, falling to -12.7%. In plain English: companies are cutting back, not building out. Whatever strength the GDPNow model sees, it is not rooted in private sector dynamism.

The broader picture is muddied by conflicting signals. On the one hand, consumer sentiment has improved modestly, with the Conference Board’s July index rising to 97.2, above expectations and June’s revised figure of 95.2. Americans are not euphoric, but neither are they panicked. A stabilizing mood could bolster Q2 retail spending, if household budgets allow it.

Then there is the matter of tariff revenues, which hit a record $28 billion in July, bringing the year’s total to $150 billion. To some, this is vindication of Trump’s America First trade strategy: forcing foreign producers to eat the cost of market access. According to Deutsche Bank, exporters are largely absorbing the new tariff burden to remain competitive in the lucrative U.S. market. Shielding American consumers from inflationary spillover, at least for now.

But this strategy has its risks. If retaliatory measures or supply chain adjustments take hold in the second half of 2025, the temporary lift in Q2 may fade as quickly as it rose. Business investment is already retreating, and forecasts from Deloitte (1.4%) and the Philadelphia Fed (1.5%) suggest far less optimism than the Atlanta Fed’s 2.9%.

The upcoming BEA advance estimate for Q2 GDP, due out July 30 at 8:30 a.m. ET, will bring clarity. While the GDPNow model has historically tracked close to BEA’s initial figures—with an average deviation of ±0.77 percentage points—it is not infallible.

What’s at stake goes beyond headlines and quarterly bragging rights. A strong number could ease pressure on the Federal Reserve to cut interest rates, affirming the view that the economy is resilient in the face of global headwinds and internal policy shifts. A weak print, on the other hand, would raise questions about the sustainability of growth under current trade and fiscal conditions.

At root, the question confronting policymakers, investors, and working Americans is this: Is the U.S. economy genuinely regaining steam or simply riding a temporary trade distortion masked by tariffs and soft data? The answer may come not in July, but later in Q3 and Q4.